Contents

Whether you’re trading futures, forex, bonds or equities, chart patterns may be implemented on any product and time frame. The ABCD pattern is one of the most basic yet effective harmonic patterns out there. It gives traders an idea of where the market might reverse and, when combined with other forms of technical analysis, it may be a great addition to your trading arsenal.

![]()

- Get real-time actionable trade ideas on dozens of popular markets based on historic price action patterns.

- You may want to buy every ABCD breakout, but know that if the midday pullback is large, the risk/reward at the breakout level will be poor.

- Directional moves are commonly referred to as “legs” and may be quantified on any duration chart, from one minute to yearly.

- If you’ve found an ABCD with legs that last longer than 13 bars, you might want to move to a larger timeframe and check for trend/Fibonacci convergence.

Stay on top of upcoming https://forex-world.net/-moving events with our customisable economic calendar. Following the initial drop from point A to B, the price rebounded to point C. The move from point C to point D provides another move lower with point D being lower low than point B. Unlike most MetaTrader 5 platforms, you’ll have access to integrated Reuters news.

Counterattack Candlestick Patterns (How to Trade & Examples)

Frankly, perhaps the most challenging part of using the ABCD trading pattern is to draw it on a price chart. Obviously, measuring the numbers independently is not something you can do regularly, and drawing the lines is not ideal as well. For that reason, you can simply use a built-in indicator on your trading platform, set the numbers, and automatically draw the ABCD pattern to a chart. As you can see, much like the bullish ABCD pattern, the bullish AB line is 61.8% of the AC line, and the CD leg is 127.2% of the BD leg. In this case, the D point is the market entry-level, stop-loss is placed above the D level, and profit targets are placed at the C and A levels. TradingWolf and all affiliated parties are unknown or not registered as financial advisors.

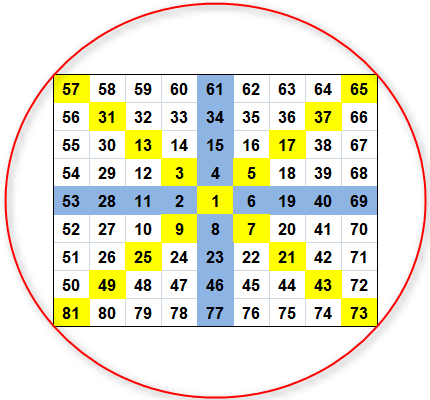

As I have already said in my previous training article, time zones mark the period of time, when a key point should be found. But even in such case we can not only avoid losses, but even make some profits. As we see in the chart above, of all the targets we marked, only point PPZ1 worked out.

A buy order may be set at or above the high of the candle at point D. Hammer Candlesticks enable traders to identify potential market reversal points, determine the ideal time to enter the market and place buy or sell orders accordingly. For more information about the FXCM’s internal organizational and administrative arrangements for the prevention of conflicts, please refer to the Firms’ Managing Conflicts Policy. Please ensure that you read and understand our Full Disclaimer and Liability provision concerning the foregoing Information, which can be accessed here. Familiarity with the wide variety of forex trading strategies may help traders adapt and improve their success rates in ever-changing market conditions. When trading reversals with the ABCD, its standing as a harmonic indicator requires that guidelines for completion of retracements and legs be established.

Check off all the boxes of your trading checklist before trading a stock. If the stock breaks your risk level, get out immediately. There will be another ABCD pattern around the corner. It’s also ideal if it’s in a hot sector, has a low float, and has news to boot.

You should carefully read and consider all terms and conditions, relevant attachments, notices, and policies before deciding whether to deal with the company. FVP Trade Ltd is a legally registered FinTech company in the British Virgin Islands. Helps to determine the risk vs. reward prior to placing a trade. Our education team will help you in your learning journey.

But who says https://bigbostrade.com/rs can’t use effective formulas if their computers do most of the grunt work for them behind the scenes? The lines AB and CD are called “legs”, while the line BC is referred to as a correction or a retracement. As a result, we use some key Fibonacci ratio relationships to look for proportions between AB and CD. Doing so will still give us an approximate range of where the ABCD pattern may complete—both in terms of time and price. This is why converging patterns help increase probabilities, and allow traders to more accurately determine entries and exits.

Tips For Trading With the ABCD Pattern

The BC price move is then changed by a bullish move called CD, which goes above point B. The bullish ABCD pattern commences with a price fall or a lower price. It is identified through a zig-zag pattern that starts at A, which extends to the price swing that we call B. The pattern is then followed by a reverse and rise in price, known as BC, which is then reversed to a bearish move , completing the pattern. Once the price completes the CD price swing, there is a reversal and an increase in the price once the price touches point D. The structure of the ABCD pattern is based on formation, like any other type of Gartley pattern.

Sign up for a demo account to hone your strategies in a risk-free environment. Must also learn to master the ABCD pattern extensions. Download the JCP app (Android/iOS) — the No. 1 forex education platform, for free. The ABCD pattern consists of three price swings —AB, BC, and CD. If you’re looking for a confluence to reassure your entry/exit decision, definitely use the ABCD pattern.

HowToTrade.com helps traders of all levels learn how to trade the financial markets. But no worries, you don’t need to calculate the lines and Fibonacci ratios on your own. Luckily, nowadays, on many trading platforms available to retail investor accounts , you’ll be able to use a built-in ABCD indicator that automatically draws the pattern for you. Once you have identified the ABCD chart pattern, you need to draw it on a trading chart, find the appropriate levels to set entry points, stop loss, and take profit orders. This strongly signals that the market is about to move in your favor. For example, if the RSI and MACD both indicate that the market is about to reverse, this is a good time to enter your trade.

Bull Flag Trading Pattern Explained

Larry Pesavento is a veteran of over 40 years in https://forexarticles.net/. He is a former member of the Chicago Mercantile Exchange where he traded S&P futures and Foreign Currency. He also traded at the prestigious Commodity Corporation of Princeton New Jersey. He also managed Drexil Burham Lambert Commodity Department in Beverly Hills, California. Larry’s library of books and trading systems has been accumulated over the past 5 decades. Larry has written 9 books on trading ranging in subjects from Astro Harmonic phenomena, Pattern Recognition swing trading and Artificial Intelligence.

The swing finally resumes and continues till it is finally at a point that has an equal distance to AB, which is seen as DA. When the leg of CD finally reaches a similar length to the leg of AB, there is a reverse mechanism that takes place for the CD price swing. ABCD pattern is a graphical representation with three price swings in a rhythmic style, depicting where the market moves. It has 3 consecutive price trends, looking like a lightning bolt on a price chart which helps determine where and when to exit and enter a trade.

Each category has a number of patterns that are common for traders to use. Each follow a specific rule set to have the pattern form which easiest to find in the marketing by using software that scans and alerts you to each occurrence. One of the most common advanced chart patterns the pattern H.M. Gartley identifies in his book Profits in the Stock Market.

ABCD pattern traders try to identify the second time when a trend loses steam and may reverse. In short, they are looking for an opportunity to buy in a market that is falling and looking for a short sell opportunity in a market that is rising. To identify a potential short entry point with the bearish formation, watch your scanner as the stock rises from A and hits a new high of day . Then wait to see if the price makes a support level higher than point A, and if it does, call this new support level C. Identifying the indicator on a price chart is the first step to opening your position. Multiday charts generally offer insight into the behaviour of stocks and markets over an extended period of time.

Trading with the ABCD pattern

Trade your opinion of the world’s largest markets with low spreads and enhanced execution. For the pattern to emerge, the price travels from A to B and then C to D. The distance between A to B and C to D should be equal. You can trade penny stocks on Robinhood as long as they are listed on a… Set price alerts just below the morning highs of each candidate. This will help you catch potential afternoon breakouts.

Forex Categories

Trading Strategies Learn the most used Forex trading strategies to analyze the market to determine the best entry and exit points. Chart patterns Understand how to read the charts like a pro trader. Today I’m going to continue the topic of harmonic patterns.